A shopper strolls down the dairy aisle when suddenly a digital screen flashes a mouthwatering Chobani ad. She wasn’t planning to buy yogurt today, but five minutes later, there it is in her cart. Magic? Nope. Just retail media networks doing their thing.

Let’s be honest: retail media networks aren’t exactly the sexiest topic at the dinner table. But if you run a store (or sell products in one), ignoring RMNs is like skipping the free money line. These powerful advertising platforms are turning ordinary store space into advertising gold mines, and the smart players are cashing in while others scratch their heads.

What is a Retail Media Network? Definition and Scope

Simply put, a retail media network (RMN) is an advertising platform where retailers sell ad space across their owned channels to brands wanting to reach shoppers. Think of RMNs as your store becoming a mini-Facebook or Google, except people are actually there to buy stuff, not just scroll mindlessly while on the toilet.

Retail media networks typically span multiple touchpoints:

- Your website (banner ads, sponsored search results, sponsored products)

- Your mobile app (personalized “suggested products” and targeted offers)

- Your physical store (digital signage screens that influence purchase decisions)

This industry is exploding faster than those TikTok dance challenges. Global retail media network spending will hit around $180 billion in 2025, growing at 14% annually. While Amazon, Walmart, and Target dominate the landscape (around 84% goes to the big players), many mid-size retailers are creating profitable RMNs without needing a NASA-sized budget.

Why Should You Care? (Hint: Money)

The benefits extend to everyone in the retail ecosystem. Look, I could dress this up in fancy business-speak, but here’s the truth: retail media networks bring in serious cash without requiring you to sell more physical stuff. It’s basically creating value out of thin air.

For Retailers (That’s You)

- Free Money: Okay, not free, but pretty close. You’re monetizing space you already own.

- Fat Margins: We’re talking 70-90% profit margins. Try getting that selling cereal.

- Better Data: You’ll learn exactly what makes your shoppers tick (or click).

- New Revenue Stream: Transform existing infrastructure into high-margin advertising inventory and diversify your revenue streams.

For Brands (Your Suppliers)

- Bullseye Targeting: They reach people who are literally standing in front of their products.

- Clear ROI: Unlike social media (where half the audience is bots and the other half is scrolling while half-asleep), RMNs deliver measurable results.

- Shiny New Formats: Video, interactive content, sponsorships that don’t look like boring ads.

For Shoppers (The People With Wallets)

- Actually Helpful Promotions: Instead of random ads for things they’ll never buy.

- Instant Gratification: See something cool? It’s right there on the shelf.

- Seamless Experience: Enjoy smooth transitions between digital and physical shopping experiences.

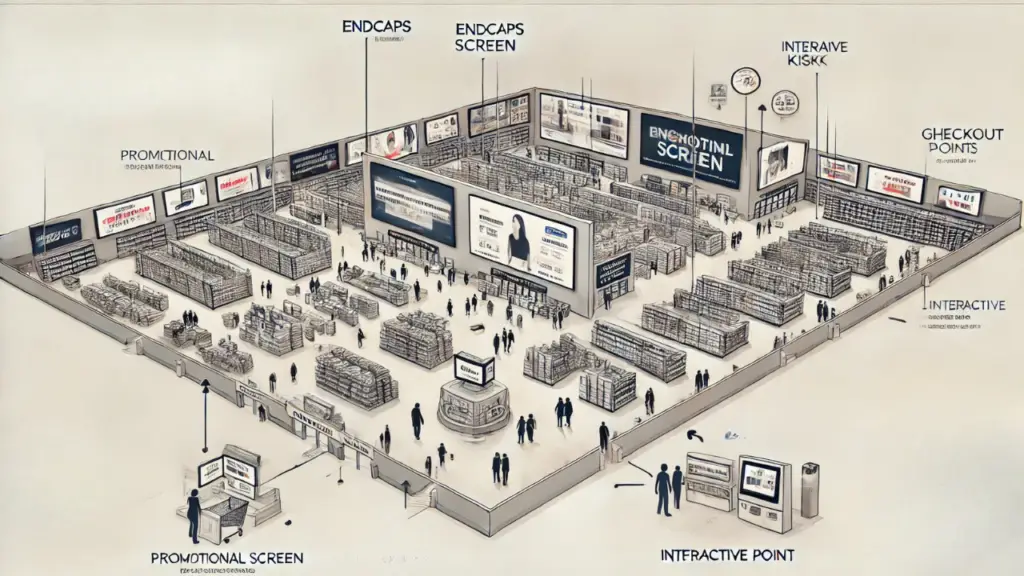

Why In-Store Digital Signage is Your Secret Weapon

Everyone and their marketing intern is obsessing over online retail media, but the smartest retailers are quietly revolutionizing their physical stores. You know, those building things where actual humans walk around and buy stuff.

In-store digital signage is the MVP of retail media networks that nobody talks about at conferences. While your competitors fight over website pixels, you could be dominating the real world with screens that actually influence purchases.

Here’s what winning in-store retail media looks like:

- Screens where eyeballs actually go: Near products, at eye level, not mounted near the ceiling like airport departure boards.

- Content that doesn’t make people’s eyes glaze over: Quick, punchy, relevant. No one’s watching a 2-minute brand story while buying toilet paper.

- Part of something bigger: Connected to online campaigns so everything feels cohesive.

- Actually measured: Not “we think people saw it” but “here’s exactly who engaged and what they bought.”

If your store aisles aren’t part of your advertising strategy, congratulations! You’ve discovered a money leak big enough to sail a yacht through. While your competitors fight over website pixels, you could be dominating the real world with screens that actually influence purchases and enhance the overall store experience.

Content That Actually Works (Not Just Looks Pretty)

Want to know what actually performs on retail media screens? Skip the arty brand videos and focus on these proven winners:

- Flash Sales: Flash Sales: “Next 30 minutes only: 25% off these chips!” Watch how fast people move, especially when integrated with your loyalty program.

- Scan-to-Save: QR codes that instantly add discounts to loyalty accounts. (Yes, people actually scan QR codes when money is involved.)

- Solution Bundles: “All ingredients for taco night: Aisle 7.” Problem, solved.

- Limited Stock Alerts: “Last 5 in stock!” Nothing motivates like FOMO.

- Seasonal Triggers: “Looks like rain tomorrow. Stock up on soup!” Context is king.

Mix in some helpful stuff (store maps, news updates) so it doesn’t feel like one long commercial break.

Need Help Getting Started?

How to Launch Without Faceplanting

Ready to join the retail media party? Here’s how to avoid the expensive mistakes everyone else is making:

1. Get the Tech Right (But Don’t Overthink It)

- Invest in high-quality digital displays that can withstand retail environments.

- Start with reliable SoC displays or players that won’t crash more often than my first car.

- Use a content management system actually designed for retail (not repurposed from digital billboards).

- Build analytics in from the beginning. Flying blind is for bird enthusiasts, not business people.

Solid platforms like STRATACACHE, Broadsign, or Creative Realities offer retail media solutions that won’t require a computer science degree to operate.

2. Use Data You’re Already Sitting On

- POS data: What’s selling, when, and to whom?

- Loyalty information: Beyond basic demographics, what do your best customers actually buy?

- Traffic patterns: Where do people linger vs. speed-walk past?

You’re probably collecting more data than you realize. Time to make it earn its keep.

3. Create a Business Model That Makes Sense

- Package premium spots like the digital equivalent of endcaps (because that’s what they are).

- Tier your pricing: prime locations cost more than the back of the store.

- Make it stupid-simple for brands to buy, measure, and repeat.

4. Start Small, Then Scale

- Pilot in your best store or two.

- Measure obsessively (sales lift, engagement, brand feedback).

- Fix what’s broken before rolling out everywhere.

Nothing kills retail media faster than a rushed, chain-wide launch that flops spectacularly.

What Winners Do (And Losers Don't)

After seeing dozens of retail ad tech ecosystems launch, I’ve noticed clear patterns in what works and what crashes and burns. Let’s get brutally honest:

The Winners:

✅ Place screens where people actually shop, not in weird corners.

✅ Keep content short and relevant (10 seconds max per spot).

✅ Make buying ad space as easy as ordering an Uber.

✅ Connect the dots between online and in-store campaigns.

✅ Actually train their staff about what’s running on screens.

✅ Connect the dots between online digital ads and in-store campaigns.

The Losers:

❌ Install screens, then forget about them for months.

❌ Run the same stale content until the end of time.

❌ Create Byzantine processes for brands to buy ads.

❌ Treat digital and physical as separate universes.

❌ Have zero process for measuring if anything worked.

When Things Go Wrong (How to Fix a Failing Network)

Already launched but seeing more tumbleweeds than results? Don’t panic. Here’s how to diagnose and fix your retail media network:

Common Fails:

- Screens in retail Siberia: Positioned where nobody goes or can’t actually see them.

- Content cemetery: The same ads running so long even the staff is sick of them.

- Workflow chaos: No clear process for updating content or ensuring it’s playing.

- Measurement black hole: “We think it’s working?” isn’t a metric.

Quick Fixes:

- Redesign templates for maximum impact in minimum time (think mobile-sized attention spans).

- Create a real content calendar with scheduled refreshes.

- Develop simple workflows so updates actually happen.

- Train store staff so they don’t stare blankly when customers ask about what’s on screen.

Retail Media Network Metrics: KPIs That Actually Matter

If you’re only counting ad dollars, you’re missing what makes in-store digital advertising truly powerful. Successful retail media networks track these key performance indicators:

- Sales lift: Did products featured in your retail media network actually sell more?

- Dwell time: Are shoppers stopping to engage with the content, or speeding past?

- Conversion rate: What percentage of people who saw a retail media ad actually made a purchase?

- Advertiser retention: Are brands returning to your retail media network, or was it a one-time experiment?

- Cross-channel impact: Do in-store retail media promotions drive online purchases later?

The holy grail for retail media networks is closed-loop measurement, tracking the customer journey from screen view to checkout beep. That’s when retail media transforms from “fancy screens” to “data-driven, revenue-generating sales machine.

Privacy Without the Panic

Let’s address the elephant in the retail media room: data privacy. As regulations get stricter and consumers get savvier, you need to thread the needle between personalization and creeping people out.

Here’s how to do it right:

- Use aggregated data: Patterns, not personal details.

- Be upfront: Tell shoppers how their data improves their experience.

- Focus on context: Often, where someone is matters more than who they are.

- Build for changing rules: What’s compliant today might not be tomorrow.

Remember: “Buy this yogurt because you always buy yogurt” is useful. “Buy this yogurt because we’ve been tracking everything you’ve done since 2018, Dave” is creepy. Don’t be creepy.

Who's Crushing It: Networks to Watch

Several in-store digital advertising stand out for actually knowing what they’re doing:

- Walmart Connect: Leveraging massive scale with in-store, online, and off-site advertising.

- Amazon Ads: The OG of retail media, still setting the pace for everyone else.

- Target Roundel: Combining rich customer data with stylish execution.

- Kroger Precision Marketing: Using purchase data for laser-targeted campaigns.

- Home Depot Retail Media+: Bringing DIY and professional customers together.

These players understand something crucial: retail media isn’t just about slapping ads on screens. It’s about creating value at the intersection of shopping data, physical space, and brand relationships.

The Hard Truth About Retail Media Networks

Let’s get real for a minute: Amazon and Walmart control 84% of all retail media ad spending. Everyone else is fighting for table scraps. That doesn’t mean you can’t succeed, but it does mean you need to be smarter.

The winning strategy for everyone who isn’t Amazon:

- Know your lane: What makes your shoppers unique? Lean into that.

- Solve real problems: Help brands reach audiences they can’t find elsewhere.

- Keep it simple: Complexity is the enemy of execution.

- Consider partnerships: You don’t have to build everything from scratch.

The Future of Retail Media Networks: 2025 and Beyond

Want to stay ahead in the data-driven in-store networks space? Here are the emerging retail media network trends to watch:

- Programmatic retail media: Automated buying for in-store ads is becoming standard practice.

- AI-powered retail media personalization: Content that adapts to specific shopper segments in real-time.

- Collaborative retail media networks: Smaller retailers joining forces to create scaled offerings.

- Enhanced analytics: Attribution models that connect impressions to purchases without complexity.

- In-store expansion: Physical retail media growing 47% in 2025 as retailers capitalize on brick-and-mortar advantages.

The Bottom Line

Retail media networks aren’t just another tech fad. They’re transforming how retailers make money, how brands connect with shoppers, and how customer experience is shaped in physical spaces.

The real question isn’t whether you should explore this medium. It’s whether you can afford not to while your competitors turn their square footage into gold mines.

Need help launching or fixing your retail media strategy? Let’s talk retail media!

Learn more in my full Retail Digital Signage insights archive

FAQ

What is a retail media network?

A system that lets retailers sell ad space across their properties (websites, apps, and in-store screens). Brands pay to reach shoppers at their most valuable moment: when they’re actively looking to buy something.

Why are RMNs suddenly such a big deal?

Because retailers realized they’re sitting on a goldmine of first-party data and screen space. With privacy changes killing third-party cookies, brands are shifting budgets toward RMNs that offer targeted reach, verified results, and direct access to shoppers at the point of decision.

How do in-store digital signage screens fit into a retail media network?

They’re the physical version of banner ads. In-store screens—when part of an RMN—let brands run targeted, time-sensitive campaigns right where customers are shopping. The best setups connect in-store content with digital campaigns for a seamless, omnichannel experience.